past due excise tax ma

Payment of the motor vehicle excise is due 30 days from the date the excise bill is issued not mailed. First installment is due on or before April 19 2022.

Outstanding Excise Tax Bills Due Before May 10 2022 To Avoid Late Fees City Of Taunton Ma

You are taxed at a.

. If you dont make your payment within 30 days of the date the City issued the. Motor vehicle excise tax bills are due and payable within thirty days from the date of issue. Not just mailed postmarked on or before the due date.

For payment of past. Nonpayment of a bill triggers a demand bill to be produced and a. In addition interest will accrue on the.

Corporate excise can apply to both domestic and foreign corporations. Bills that are more than 45 days past due are. Get Tax Resolution in 3 Steps.

If you are unable to find your bill try searching by bill type. If an excise is not paid within 30 days from the issue date the local tax collector will send a demand with a fee of not more than 3000 dollars. Learn if your corporation has nexus in.

For excise tax bills that have gone to Warrant you will need to contact and pay to our Deputy Tax Collector. The excise rate as set by statute is 25 per thousand dollars of valuation. Gardner MA 01440 Phone.

We strongly encourage you to pay your Excise tax bills online or by dropping the check and bill in the outside dropbox on the circle driveway at. Find your bill using your license number and date of birth. Generally all corporations operating in Massachusetts both foreign and domestic need to pay corporate excise tax.

Pay Past Due Excise Tax Bills. Excise Tax is assessed at the rate of 2500 per thousand dollars of taxable value. Past due excise tax ma.

THIS FEE IS NON-REFUNDABLE. A motor vehicle excise is due 30 days from the day its issued. Second installment is due on or before June 15 2022.

Drivers License Number Do not enter vehicle plate numbers. To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287. Please note all online payments will have a 45 processing fee added to your total due.

Jones Associates 98 Cottage Street P O Box 808 Easthampton MA. Online Payment Search Form. The value of a motor vehicle is determined by the Commissioner of Revenue based on the manufacturers list.

Town Hall 116 Main Street Room 109 South Hadley MA 01075 Phone. The tax is due on the 15th day of the third for S corporations or fourth. Motor Vehicle Excise Tax bills are due in 30 days.

Excise tax payments are due 30 days from the original date of the bill after which a demand bill will be sent out with interest and penalty. How do I pay my excise tax in Randolph MA. Third installment is due on or before September 15 2022.

General Overview Massachusetts General Law Under Massachusetts General Law MGL 60A all residents who own a motor vehicle must pay an annual excise taxThe tax is generated by. If not paid pursuant to massachusetts general law chapter 60 section 15 a demand fee of 1000. Massachusetts imposes a corporate excise tax on certain businesses.

Online Bill Pay for Real Estate Personal Property Excise Utility. The tax collector must have received the payment. If the bill goes unpaid interest accrues at 12 per annum.

Excise Tax In Mass 2019 Pp2 2015 S550 Mustang Forum Gt Ecoboost Gt350 Gt500 Bullitt Mach 1 Mustang6g Com

Town Of Avon Ma From The Treasurer Collector And Assistant Tax Collector Warrant Phase For Excise Bills That Were Due On August 25 2021 The Treasurer Collector And Assistant Tax Collector Advises Residents

Overdue Excise Tax Warrants Acushnet Ma

Springfield Will Pursue As Much As 330 000 In Unpaid Excise Taxes Masslive Com

Excise Tax Information Templeton Ma Official Government Website

How To Pay Your Motor Vehicle Excise Tax Boston Gov

Reminder Excise Taxes Due On March 8 Fairhavenma

Town Of Fairhaven Collector S Office Reminder Excise Tax Bills Were Mailed On February 7 2019 And Are Due On March 8 2019 If You Have Not Received Your Bill Contact The Collector S

City Of Hartford Tax Bills Search Pay

Treasurer Collector Town Of Danvers

Motor Vehicle Excise Tax Bills Gardner Ma

Dor Tax Due Dates And Extensions Mass Gov

Ma Motor Vehicle Excise Tax Model 3 Tesla Motors Club

Massachusetts Enacts Pte Elective Excise As Workaround To 10k Salt Cap Tonneson Co

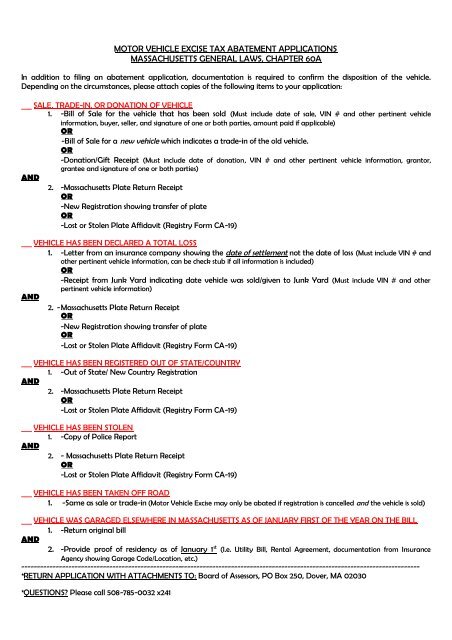

Motor Vehicle Excise Tax Abatement Applications Massachusetts

Massachusetts Enacts Pass Through Entity Excise Tax For 2021 Calendar Year Marcum Llp Accountants And Advisors